excise tax division nc

For general information call 1-877-252-3052 and for individual income tax refund inquiries call 1. Internal Revenue Code 4121 imposes an excise tax on coal from mines located in the United States sold by the producer.

Franchise Tax Corporate Income Tax Privilege Tax Insurance Premium Tax Excise Tax Rules And Bulletins Taxable Years 2008 Supplement State Publications Ii North Carolina Digital Collections

Pittsboro NC 27312 which is the government annex building on the south side of the Pittsboro circle.

. 1 2020 Information Who Must Apply Cig License. North Carolina Department of Revenue Excise Tax Division. The move is scheduled for the week of May 10 2021 and the.

Raleigh North Carolina 27604. Corporate Income Tax Tax Administration PO Box 7206 Indianapolis IN 46207-7206. Real estate excise tax also known as revenue stamps is imposed by North Carolina law and collected by the Register of Deeds at the time of recording.

5595 million in FY 2021 nearly 20. Box 201 617 North Third Street Baton Rouge LA 70821-0201. Appointments are recommended and walk-ins.

Since October 15 is a Saturday file by. The tax rate is 2 per 1000 of the sales price. Imposition of excise tax.

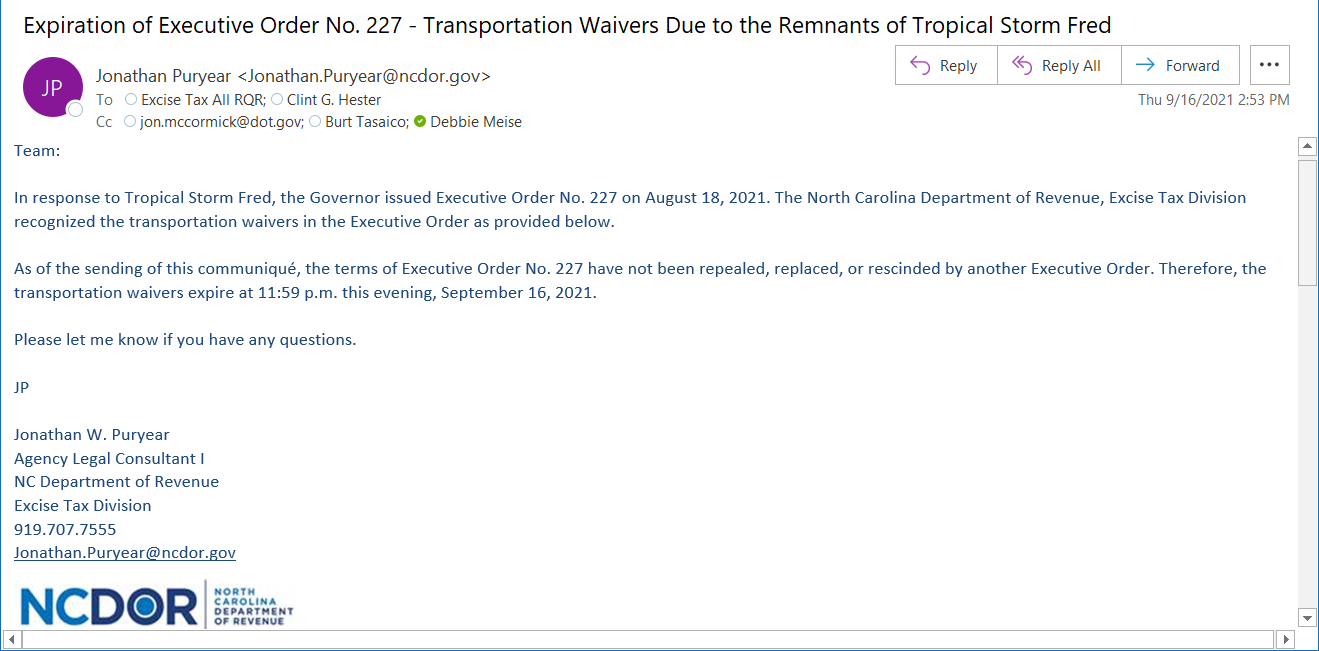

If you need assistance please contact the Excise Tax Division toll-free at 1-877-308-9092 or 919 707-7500 Monday through Friday between the hours of 800 am to 500 pm Eastern. Tax Listing Division and Appraisal Division are located at 12 East St. The Excise Division is comprised of two functional sections.

EFile Your Business Income Tax Return. Schedule payments for taxes due estimates. Motor Fuels and Alternative Fuels Tax Rate from January 1 2014 through June 30 2014.

Contact us by phone mail or in person. 1st and 2nd Quarter 2014 Gas-1200 Motor Fuels. The tax is levied on conveyances of.

For assistance with Motor Fuels e-Services please contact the Excise Tax Division at 1-919-707-7500 1-877-308-9103 Live telephone assistance is available to answer your questions. The excise tax is deposited in the Black Lung. Also please have your confirmation pages available when you contact the Division with questions.

Excise Tax on Coal. Motor Fuels and Alternative Fuels Tax Rate October 1 2013 through December 31 2013. Vendor Operations Taxpayer Specialists assigned to vendor operations work with vendors throughout the life of their.

EFile your current amended prior and short year returns for Corporate Income Franchise and Partnership. The NCDOR is committed quality customer service. If Balance Due - Mail the return and a check for the balance due to the North Carolina Department of Revenue.

3301 Terminal Drive. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

If you file your individual income tax return on a calendar year basis and have a valid extension for 2021 then October 15 is the deadline to file your return. If return is on time but underpaid 10 of tax due or 50 whichever is greater is due. The tax rate is one dollar.

If you need assistance please contact the Excise Tax. Have you ever wondered how to calculate the revenue stamps excise tax on the sale of real estate in North Carolina. 1st and 2nd Quarter 2013 Gas-1200 Motor Fuels Claim for Refund Nonprofit Organizations.

Ifta Inc International Fuel Tax Association

Controversy Stirs N C Liquor System Business North Carolina

Excise Tax On Conveyances Net Collections By County For Last Five Years State Publications I North Carolina Digital Collections

North Carolina Department Of Revenue Wikipedia

Ken Hocutt Revenue Administration Officer Iii Excise Tax Division Nc Department Of Revenue Linkedin

Excise Taxes Excise Tax Trends Tax Foundation

3 11 23 Excise Tax Returns Internal Revenue Service

Nc Has 8th Highest Beer Tax In The Nation

3 11 23 Excise Tax Returns Internal Revenue Service

North Carolina Motor Fuels Tax Bond A Comprehensive Guide

Property Tax Firms In Charlotte And Mecklenburg North Carolina

A Road Map To Recreational Marijuana Taxation Tax Foundation

Management S Discussion And Analysis Highway Trust Fund Fy06

Customer Service Numbers Ncdor

Excise Taxes Excise Tax Trends Tax Foundation

N C Beer Wine Ncbeerwine Twitter

Statistical Abstract Of North Carolina Taxes 2007 State Publications Ii North Carolina Digital Collections